13

Irish Pensions Magazine Spring 2014

Advertorial

Analysis

With schemes typically holding highly-concentrated,

equity-dominated

growth

portfolios,

further

diversification would clearly be in the interests of

many. With an array of alternative growth asset classes

available, such a move need not harm the expected

return too much; at the same time, the benefits of lower

risk brought by diversification can be captured.

Liability matching

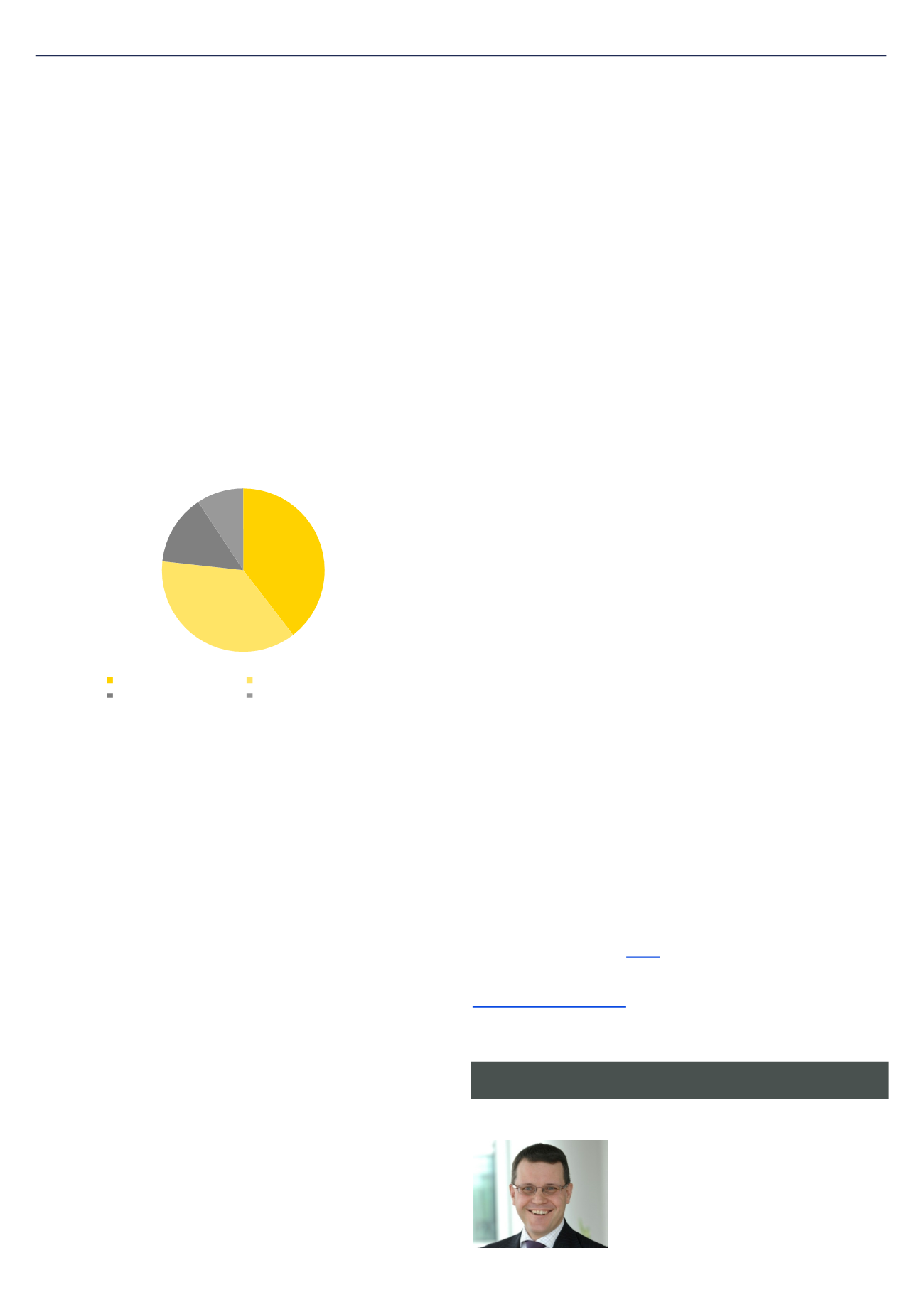

Our survey also asked respondents to provide details

of their plans around liability matching. Around 37%

of schemes surveyed had plans to increase the asset

allocation to bonds, and a further 14% of schemes said

that this was currently under discussion. In addition,

around 44% of schemes have considered or are using

financial instruments (e.g. interest rate or inflation

swaps, and derivatives) to manage risk, with 16% of

schemes already using them as part of their strategies.

So progress is being made in toning down key risks,

such as exposure to nominal interest rates and inflation.

One interesting finding was the large growth in the

use of “dynamic de-risking” approaches, whereby the

re-allocation of return-seeking assets to bonds takes

place when pre-defined trigger points (e.g. often based

on funding level) are hit. Whilst these techniques can

allow schemes to take advantage of favourable market

conditions along their de-risking journey, the challenge

for trustees and companies in using these approaches

is in ensuring their governance arrangements are

robust (most of these strategies require some level of

delegation of investment duties), and in making sure

they are getting good value for money from these

services.

A further challenge for trustees and companies is in

ensuring that their liability matching portfolios are

well-hedged. The lack of availability of long term,

high quality fixed interest instruments is a challenge

for schemes. It means that for many, their matching

portfolios have a shorter duration than the liabilities

they seek to cover. This finding is supported by a

separate survey on investments published by the IAPF

in 2013. Whilst this mismatch leaves many schemes well

placed to benefit from an up-tick in interest rates, there

is always the possibility of a further fall in rates, and the

challenge of achieving a better matched position in the

future remains.

The current environment

Recent regulatory changes, such as the Funding

Risk Reserve, have increased the focus on having an

integrated funding and investment strategy. We expect

this drive towards a more joined-up view of funding

and investment risk to continue. The outcome of the

Element 6 case may also lead more trustees to start

building in assessments of the employer’s financial

strength into their decision making processes, and this

should include decisions on the level of investment

risk the scheme is prepared to take, and the modelling

of “worst-case scenarios” if things do not turn out as

planned.

Trustees will continue to feel the pressure of an ever

complex pensions landscape, with increasing demands

on both their time and expertise. Getting the right

advice will be important to good decision making. New

governance solutions in the investment space, built

around intelligent delegation of investment duties,

can help trustees focus more of their time on the

key risk areas, leaving the less important decisions to

specialists. For schemes wishing to go down this route,

the challenge will be in understanding the solutions

available, monitoring performance, and getting value

for money.

Final thoughts

Wherever schemes are on their journey to investment

de-risking, there are clear challenges ahead.

Underfunded schemes relying on asset outperformance

to fund deficits should carefully consider their asset mix,

in particular diversification within the growth portfolio,

to help optimise their quest for higher returns. Equally

important for schemes with large matching portfolios

is ensuring the robustness of the hedges they have in

place, and ensuring that these arrangements stand up

against changes in the economic outlook.

Having a realistic, well-considered investment strategy

in place is key to good risk management. A shift in

the Zeitgeist, spurred on by regulatory pressure and

changes to the funding standard, has meant that steps

are being taken to improve investment strategies.

More consideration is now being given to the potential

impact of these strategies on members and sponsoring

companies alike, but there is an opportunity to take this

further. With the direction of regulation a little clearer

than before, but with uncertainty and volatility in the

investment markets looking set to continue, now, more

than ever, it’s time to grasp the nettle.

The full results of our Pensions Risk Survey can be found

on the IAPF website

For further information please email us at:

or

Christopher Bown on +353 1 221 2498.

Article Author

40%

37%

14%

9%

Yes, already implemented Yes, planning to implement

Under discussion

No

Christopher Bown

Director

EY

Figure 2: Plans to increase bond allocation